FAQ! Need Help

ePayloan is the one you can rely that will support you all the way by offering Loan facilities.

Do you have Questions?

Frequently asked Questions

- 1. General Question

- 2. Eligibility & Documentation

- 3. Loan Approval

- 4. Receiving Fund

- 5. Repayment Loan

- 6. Referral Program

- 7. Cashback Program

General Question

We operate on a 24/7 basis to provide enhanced service to our customers. Our commitment ensures that we remain readily available whenever our customers require emergency financial Assistence. We do not take any days off, ensuring uninterrupted support for our clientele.

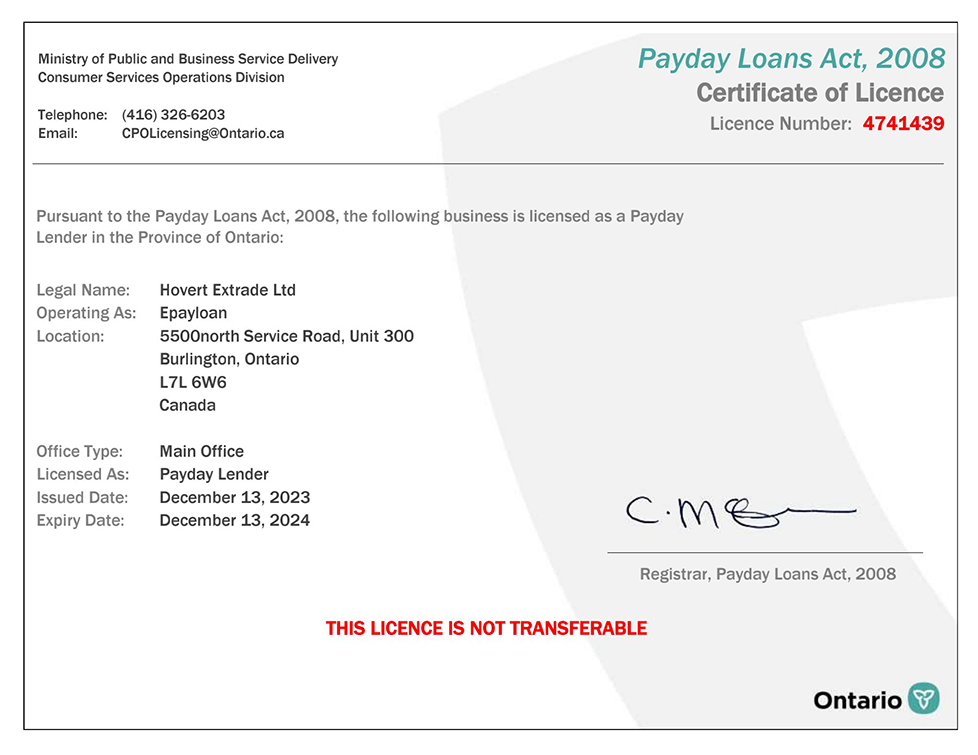

At present, our services are exclusively available in Ontario. However, we are actively working on expanding our reach to include other provinces. During the application process, you will have the option to select from the provinces where our loan services are available.

Yes, we do extend loans to individuals with a bad credit history. In our assessment process, we consider various factors beyond just credit scores. We carefully review your past data to make informed decisions regarding your application.

Our application process is designed to be simple and convenient, accessible entirely online. You'll only need to create an account and fill out the online application that will ask for your basic information such as your name, address, employment details, and references. Our entire process is paperless, greatly enhancing convenience for our customers. We utilize a secure third-party service that seamlessly connects to your bank account and provides us with your bank statements for loan approval decisions.

No! Unlike other lenders, ePayLoan does not perform credit checks. We make decisions based on your income and ability to pay the loan

ePayLoan is an online licensed private lender offering loans ranging from $100 to $1500, with repayment due on your next pay date. The repayment period can vary from your next pay date to 62 days, in accordance with the rules and regulations of your province.

Eligibility & Documentation

No, we do not accept applications over the phone. You can apply 24/7 online at www.epayloan.ca. If you have any question with our application then we are always available.

Loan approval amounts are typically calculated based on various factors such as your income, credit history, existing debt obligations, expenses, and the lender's specific criteria. Lenders assess your ability to repay the loan by considering your income and expenses to determine the amount you can reasonably afford to borrow.

The application form requests basic information including your Name, Address, employment details, and references. If you have all the necessary information readily available, completing the form should take no longer than 10 minutes. Supporting documents are collected using secure third-party services, ensuring convenience for both you and us. We will guide you through out the application so you don't miss anything.

No, there is no application fee.

- Be at least 18 years old, or 19 years old in BC, NB, and NC.

- Reside in the province where we operate.

- Demonstrate consistent income from the same source over the past three months.

- Maintain a minimum total net income of $750 per month.

- Possess an active online bank account.

- Provide a valid mobile phone number, email address, and residential address (VOIP numbers are not accepted).

Kindly note that the cost of borrowing is regulated by the consumer protection laws of each province in which we are licensed. In provinces such as ON, BC, NS, NB, PEI, and AB, the interest rate is fixed at $15 per $100 borrowed. However, in Manitoba, the interest rate is set at $17 per $100 borrowed.

We do not require any documentation from you. Simply fill out the online application form and submit it. The remainder of the process is automated. With your authorization, our secure third-party service will provide us with your bank statements, enabling us to make informed decisions regarding your loan.

We accept all income types as long as they meet our requirements. Some examples include child tax, CPP, WICB, Old Age Security, ODSP, and more. Simply fill out the benefit income section in the employment details, and we will handle the rest.

Loan Approval

We strictly provide the loan amount requested by the applicant. However, in instances where our assessment indicates that the applicant qualifies for a lower amount than requested, for example, if the applicant applies for $500 but our algorithm determines eligibility for $400, we can only approve the lower amount of $400. Loan approval amounts are determined based on a comprehensive evaluation of factors including income, credit history, existing debt obligations, expenses, and specific lender criteria. This assessment ensures that the approved loan amount aligns with the applicant's ability to repay.

The loan repayment must adhere to the original terms and conditions outlined at the time of borrowing. The system automatically selects your next pay date as the repayment date, ensuring compliance with provincial legislation, with a maximum repayment period of 62 days. However, if your next loan repayment date does not coincide with your next pay date, please email us at support@epayloan.ca with the relevant details.

For your convenience, our entire system is digitalized. Your contract will be emailed to you via SignNow, allowing you to sign electronically. Before signing the contract, please review the details carefully and ensure that your loan repayments align with your next pay dates. If you haven't received the contract via email, please check your spam or junk email folder. If you still haven't received the email, please contact us at support@epayloan.ca for further Assistence.

After approval, we will send you the contract for signature. Upon completion of the signing process, you will receive the funds via Interac transfer within 30 minutes.

Prior to signing the contract, please ensure that the loan repayment date(s) align with your next pay date(s). If adjustments are needed, kindly send your requested repayment dates along with details via email to support@epayloan.ca. Please note that once the contract is signed, we are unable to modify the repayment dates.

Each province has its own set of rules and regulations regarding income consideration. Some provinces consider the average income over the past three months, while others only consider the income from the last month. If we have overlooked any of your paychecks or secondary income sources, please contact us at support@epayloan.ca, and we will verify this information for you.

After determining the customer's income, we adhere to legal regulations that permit lending up to a predetermined percentage of their income. Following this guideline and our internal assessment of the customer's ability to comfortably repay, the approved loan amount may be lower than the requested sum.

We regret to find that your loan application was declined. Several factors contribute to this decision, including an analysis of your historical data such as income, bill payment records, existing loans, repayment history, and credit history, among others. Our priority is to ensure that you do not encounter difficulties in repaying the loan, hence, approval is granted only when we are confident in your ability to manage timely repayment. You are most welcome to re-apply when your circumstances change.

If you believe that the wrong account has been selected in the pre-authorization form, please contact us at support@epayloan.ca and provide detailed information about the error. A member of our team will promptly assist you.

However, please note that once the contract is signed, we are unable to modify the bank account selected for the pre-authorized debit form.

Receiving Fund

Certainly! Upon signing the contract, you can receive your funds via e-transfer, which typically arrives within a few minutes. If you do not receive an email within an hour, please check your junk and spam folders. If you still have not received the email, please contact us at support@epayloan.ca for further Assistence.

Please note that when filling out the application, please select "e-transfer" when prompted for your preferred method of receiving funds.

Yes, you have the option to receive your funds via direct deposit into your bank account. Please be aware that bank transfers may take anywhere from 1 to 3 days, depending on the policies of your bank. If you prefer direct deposit, please select this option when filling out the application form and indicate "direct deposit" as your preferred method of receiving funds. Alternatively, if you require funds quickly, typically within an hour of signing the contract, you can choose the e-transfer method.

E-transfer and direct deposit are both methods of electronically transferring funds, but they have distinct characteristics:

**E-transfer (Interac e-Transfer)**:

- E-transfer enables individuals to transfer funds from one bank account to another via email or text message.

- Upon receiving the transfer, the recipient is notified and provided with instructions on depositing the funds into their bank account.

- The availability of funds is typically immediate or within a few minutes once the recipient accepts the transfer.

**Direct Deposit**:

- Direct deposit involves electronically transferring funds directly into the recipient's bank account, without requiring any action from the recipient.

- The recipient needs to provide their bank account details, including the account number and routing number, for direct deposit to occur.

- While the timing of direct deposit can vary based on the sender's and recipient's banks, funds typically become available within 1 to 3 business days after the deposit is initiated.

In essence, e-transfer is convenient for quick, one-time payments, whereas direct deposit is more suitable for recurring payments and may take slightly longer to process.

The password for the e-transfer will be sent to you via email. If you have not received the email, please check your junk or spam folders. Should you still not receive it, please contact us at support@epayloan.ca for Assistence.

Repayment Loan

The timeframe for debiting your account may vary depending on the bank institution. This discrepancy arises because banks need to update their records and process these requests internally. While larger banks typically process transactions swiftly, smaller institutions may take longer to complete debits or deposits.

If you do not see the debit in your account in the morning, we recommend waiting until the afternoon to check if it has been processed. If the payment still does not appear the following day, please contact us via email at support@epayloan.ca for further Assistence.

Please note that repaying by e-transfer in advance will NOT allow you to reapply immediately for residents of Alberta, Manitoba, and Nova Scotia. In Alberta and Nova Scotia, you will not be able to reapply until the final payment due date that was scheduled in your loan agreement. In Manitoba, you will have to wait 7 days after your final payment date before you can reapply for a new loan, in accordance with Manitoba regulations.

For other provinces, contact support@epayloan.ca for repaying early.

We can only provide one loan at a time. As a licensed lender, we are subject to the consumer protection laws of each province where we operate. These regulations prevent us from offering a second loan until any previous loan has been fully repaid. Once your current loan is fully repaid, you will be eligible to apply for a new loan.

At ePayLoan, we do not report your payments to credit bureaus since we operate as a short-term lender. It's essential to understand that to affect credit files, payments need to be reported over an extended duration to these bureaus.

Please be aware that any outstanding loans forwarded to collections will indeed have repercussions on your credit score.

We initiate direct debits for your payments from your bank account in accordance with the dates specified in the contract.

According to your agreement with ePayLoan, it's crucial to honor the payment dates specified in the contract.

Should a payment be missed, one of our Collection Account Specialists will contact you to offer a personalized solution suited to your needs.

We strongly advise maintaining sufficient funds in your account on scheduled payment dates to avoid incurring additional fees resulting from missed payments.

The Payment dates are mentioned in the contract and you can also check in user profile under the current loan tab.

ePayLoan promotes responsible lending and strives to facilitate your borrowing experience. However, not repaying your loan can lead to a negative credit report, potentially lowering your credit score.

If you fail to repay your loan by the due date(s), it will be considered delinquent and may incur NSF fees of up to $48, depending on your province, for each missed payment. Additionally, late interest will accrue on any unpaid balance at an annual rate of up to 59%, depending on your province. Your account may be sent to an external collection agency or pursued in court, resulting in legal, court, and administration fees that you will be responsible for.

It is unwise to leave your balance unpaid. If you encounter financial difficulties, please notify us so that we can assist you in creating a suitable repayment plan.

In the event that a payment is returned to your bank account due to reasons such as non-sufficient funds, stop payment, or account freeze, we will impose an NSF fee. Additionally, your bank may also charge you an NSF fee. The NSF fees applicable to your province are as follows:

- British Columbia: $20

- Alberta: $25

- Manitoba: $5

- Ontario: $25

- Nova Scotia: $40

- New Brunswick: $20

- PEI: $48

Referral Program

Once you have successfully obtained and repaid your first loan on time, you can refer your friends or family members to our services. Simply navigate to your user profile, where you will find a "Refer a Friend" link button on the right side. This button will become active, allowing you to easily refer others to our platform.

You can refer as many friends as you like. The more referrals you make, the more money you can earn. Spread the word and increase your earnings. Take full advantage of this program to maximize your benefits.

- If you refer a friend, you will receive 20$ per referral for the first five referrals, 25$ per referral for the next 5 referrals, and earn up to $50 per referral when he refers at least 35 people.

- To qualify for the referral bonus, your referred individual must have successfully obtained a loan and repaid it on time, adhering to the original terms and conditions.

- The loan is deemed as paid once ePayLoan has received the funds in our bank account and the status has been updated to "completed."

- Once the loan status of your referred individual is changed to "completed," you will receive the referral bonus directly into your wallet.

- Your earned Cashback and Referral bonus both will be deposited into your wallet. They can be redeemed once the total amount reaches $25 or more and other conditions are met.

Your referral bonus will be credited in your wallet. Once your wallet reaches $25 or more you can redeem the amount by requesting us.

Cashback Program

For the first nine loans, the cashback amount will be 7% of the cost of borrowing (interest on the loan). The tenth loan will be interest-free. For the next set of loans, from the 11th to the 19th, the cashback amount will be 14% of the cost of borrowing. The 20th loan will be interest-free. For loans onwoards 21, the cashback will be 21% of the cost of borrowing, with the 30th loan being interest-free. Additionally, every 40th, 50th, and subsequent milestone loans will also be interest-free.

- You must not be undergoing bankruptcy, consumer proposal, or enrolled in a debt consolidation program

- No current or past loans with ePayLoan should have been written off.

- Your Loans should have been paid back with original terms and conditions.

- Alberta and Nova Scotia residents: To qualify for Cashback, you must not have repaid your loan in advance (before the last payment due date of your Loan Agreement)

- Manitoba and New Brunswick residents: Not eligible for the cashback program.

- Check Terms and Conditions for more requirements.

- To qualify for Cashback, you must fulfill all conditions outlined in Terms & Conditions.

- Your ePayLoan account must maintain good standing, meaning it has no outstanding balance from the current or previous loans.

- A minimum of $25 Cashback must be available for redemption.

- Cashback can be received via e-transfer to your primary ePayLoan email address.

- Your ePayLoan account must not have been voluntarily closed.

- Check Terms and Conditions for more requirements.

- Your Cashback will expire after six (6) months of inactivity in your ePayLoan account, which is defined as no activity for six (6) months following the last payment recorded.

- The six (6) months will be calculated from the same calendar date of the sixth consecutive month, or if such date doesn't exist, it will end on the last day of that sixth month.

- Reactivation of your account will occur automatically upon obtaining a new loan with us before the end of the six (6) month period.

- Once Cashback expires, it becomes unrecoverable, even upon reactivation of your account at a later date.

Get up to 21% in Cashback

The Cashback program, devised by ePayLoan, is specifically crafted to offer advantages to our clientele. It's important to note that we retain the discretion to modify or discontinue the program in the future without prior notification. Below, you'll find the program's specifics:

Refer a Friend - Earn Up To $50*

Unlock earning potential with ePayLoan's referral program. Refer friends and watch your wallet grow with every sign-up. Join today and turn connections into cash effortlessly.