Page is under construction

Renewals

ePayLoan offers one loan at a time. You can apply for another loan once the current loan is completed. Check Terms & Conditions for more information.

APR Disclosure

Interest fees

In Alberta, British Columbia, New Brunswick, Nova Scotia, Ontario, and Prince Edward Island, the rate is $15 for every $100. In Manitoba, Saskatchewan, and Newfoundland & Labrador, the rate is $17 for every $100.

Head Office

The head office of ePayLoan is situated at 300-5500 North Service Rd., Burlington, ON, L7L 6W6. Unless specified otherwise, ePayLoan offers its services strictly online.

British Columbia Residents

ePayLoan will offer payday loans in British Columbia in future (license number: In Progress)

Ontario Residents

The maximum permissible cost of borrowing under a payday loan agreement is $15 per $100 borrowed. For a $500 loan with a 14-day term, the total borrowing cost amounts to $75, resulting in a total repayment of $575 and an APR of 391.07%. For a 62-day loan, the APR is 88.31%.

Manitoba Residents

The APR on a $300.00 loan for 12 days is 517.08% on a rate of $17.00 per $100.00 borrowed. To learn more about your rights as a payday loan borrower, contact the Consumer Protection Office at 1-204-945-3800, 1-800-782-0067 or at www.manitoba.ca/cca/cpo.

Nova-Scotia Residents

Payday loans are high-cost loans. The maximum allowable cost of borrowing under a payday loan agreement is $15 for every $100 received. For a $100 loan over 14 days, the total borrowing cost is $15, resulting in a total repayment amount of $115 and an APR of 391.07%.

PEI Residents

The maximum permissible cost of borrowing under a payday loan agreement is $15 for every $100 advanced. For a $300 loan over 14 days, the total borrowing cost is $45, resulting in a total repayment amount of $345 and an APR of 391.07%. For a loan term of 62 days, the APR is 88.31%.

Note: Please be aware that the Cashback Program is not available to customers in Manitoba and New Brunswick. The Referral Program is also unavailable to members in Manitoba, New Brunswick, and British Columbia. In Alberta, loans range from 42 to 62 days with 2 to 7 payments, depending on income frequency. In Ontario, loans are limited to a single repayment, except for a third loan within 63 days. In Nova Scotia, provincial regulations restrict loans to a single repayment. Approval is not guaranteed and conditions apply. ePayLoan product offerings vary according to provincial laws.

Our website utilizes cookies to facilitate essential functionality and enhance user experience. Your use of this website implies acceptance of our Terms and Conditions as well as our Privacy Policy.

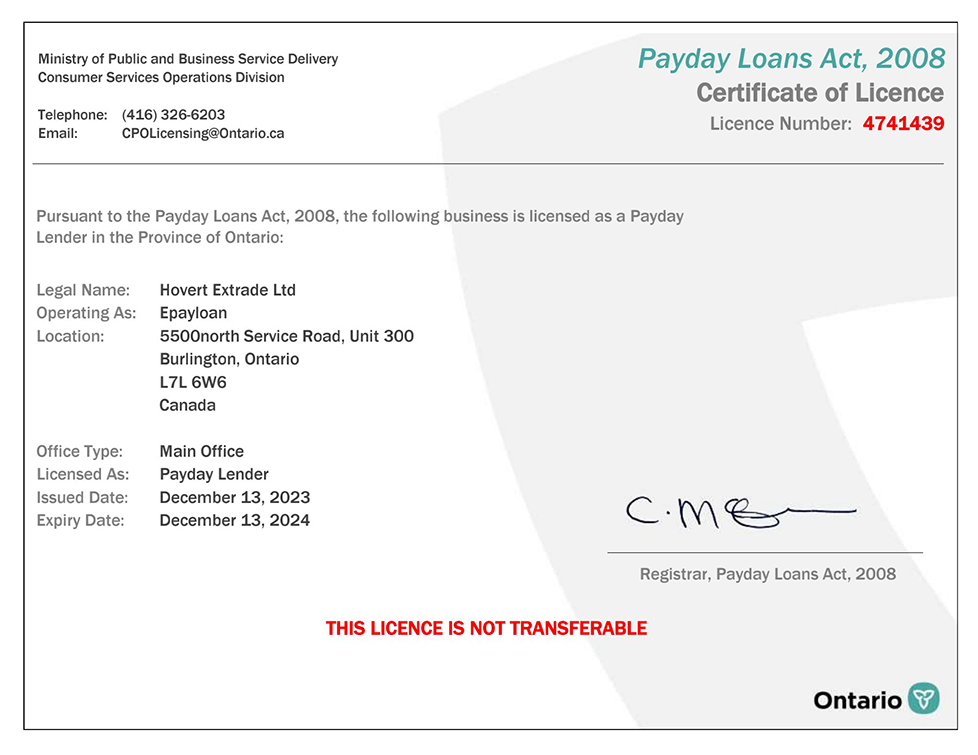

ePayLoan is a licensed and direct lender in Ontario, specializing in providing Payday loans.

ePayLoan is a responsible short term lender regulated by provincial laws. We are fully licensed, transparent and 100% compliant.

Maximum Allowable Cost per $100 Borrowed: $15.00

Our cost per $100 borrowed: $15

Example: Your $500 loan for 14 days

Amount Advanced $500.00 Total Cost of Borrowing: $75 APR: 391%

Total You Repay: 575$

This poster is required under the Payday Loans Act, 2008

Educational materials related to the Payday Loan industry are available for download. If you wish to obtain copies of educational material approved by the Registrar, Payday Loans Act, 2008 pleasea click here

Payday Loan Business Licence Number: 4741439

Continue