Online Payday Loan in Alberta!

Get an online payday loan in Alberta. Borrow up to $1,500 in a few minutes. Use it for all unexpected expenses. Fast e-transfer anytime, day or night, and on weekdays or weekends. Easy to apply loan. Apply online now!

Apply Now!

Alberta - Payday Loans?

Alberta Payday Loan - ePayLoan

Payday loans in Alberta are short-term loans that allow people to borrow up to $1,500 for unexpected expenses. They are useful for those who need cash quickly before their next paycheck. These payday loans are popular because they have helped millions of people to manage their financial challenges. Many Canadians rely on online payday loans with instant approval.

New customers can apply now and get their money via e-Transfer with no additional cost. This service is available 24/7.

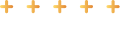

Here is more information on how payday loans work: Click here! In Alberta, lending companies are regulated to ensure fair practices and protect borrowers.

Why do you need a Payday Loan?

Payday loans in Alberta are useful for many people who need quick money to deal with short-term financial problems. These loans let you borrow up to $1,500 and can help in several situations.

Uses of Payday Loan in Alberta

One of the main reasons people use payday loans is to pay for unexpected expenses. Things like car repairs, medical emergencies, or urgent home repairs can create sudden financial stress. A payday loan gives you quick money to handle these costs without waiting for your next paycheck.

Payday loans are helpful for covering gaps between paychecks. If you run out of money before your next paycheck, it can be very stressful. Payday loans provide a temporary financial cushion so you can pay for things like groceries, utility bills, and rent on time.

When your bank account is low, payday loans can help you avoid expensive overdraft fees. By borrowing a small amount to cover necessary expenses, you can keep your account from going negative and avoid extra charges.

Certain times of the year bring extra expenses that can strain your budget. Holidays, back-to-school shopping, and seasonal changes often require more money. Payday loans help you manage these seasonal costs without disrupting your regular budget.

Emergencies, such as a family member’s illness or death, may require immediate travel, which can be expensive. Payday loans provide quick money so you can travel on short notice without financial stress.

Payday loans in Alberta are a valuable financial tool for people facing short-term money problems. They offer quick access to cash for unexpected expenses, covering gaps between paychecks, avoiding bank fees, managing seasonal costs, emergency travel, and supporting small business needs. While they are not a long-term solution, payday loans provide important short-term help, making it easier for people in Alberta to handle financial difficulties.

How does an online Payday Loan in Alberta work?

Online payday loans offer a quick and convenient way for individuals to access short-term financial assistance, particularly in times of urgent need. In Alberta, these loans allow borrowers to obtain up to $1,500 with minimal hassle, often through a straightforward online application process that can be completed in minutes. This speed makes online payday loans an attractive option for covering unexpected expenses such as car repairs, medical emergencies, or urgent home repairs that cannot wait until the next paycheck.

The application process for an online payday loan is typically simple and user-friendly. Applicants need to provide basic personal information, proof of income, and a bank account for the funds to be deposited. Many online payday loan providers offer 24/7 services, ensuring that borrowers can access funds whenever they need them, without being constrained by traditional banking hours.

Despite their convenience, it's crucial for borrowers to understand the high-interest rates and fees associated with payday loans. These loans are designed for short-term use and can become expensive if not repaid promptly. Therefore, while online payday loans can provide essential financial relief in emergency situations, they should be used responsibly. Borrowers are advised to carefully read the terms and conditions and ensure they have a plan to repay the loan on time to avoid falling into a cycle of debt.

Alberta Payday Loans Eligibility

To qualify for a payday loan in Alberta, you must be an adult, have a regular income, and show valid identification. The paperwork is minimal, making the process quick and easy. For a Payday loan, you need to meet these criteria:

1. Be at least 18 years old (19 years old for applicants in British Columbia, New Brunswick, Nova Scotia).

2. Show that you have been receiving the same source of income for the past three months.

3. Have a total net income of at least $750/month.

4. Have a valid mobile phone number, address, and email address (VoIP numbers are not accepted)

5. Have access to an online bank account.

In Alberta, it's simple to qualify for online payday loans, making it easier for Canadians to get financial help. The main focus is on your ability to repay the loan, promoting responsible borrowing. Understanding the application process and the necessary documents is important for a successful application.

Alberta Payday Loan : What is it?

- Payday loan is usually a small value loan taken out for a short time, typically until your next payday

- an unsecured loan (you cannot put any property as collateral or guarantee for the loan, you need to provide the lender with a post-dated cheque or a pre-authorized debit)

- loaned at a retail store or online

- Most Payday lenders ask to prove three months of employment.

- Some lenders may ask for a credit check and some may not.

- Payday lenders will require to have a bank account.

FAQs

Our application process is designed to be simple and convenient, accessible entirely online. You'll only need to create an account and fill out the online application that will ask for your basic information such as your name, address, employment details, and references. Our entire process is paperless, greatly enhancing convenience for our customers. We utilize a secure third-party service that seamlessly connects to your bank account and provides us with your bank statements for loan approval decisions.

We do not require any documentation from you. Simply fill out the online application form and submit it. The remainder of the process is automated. With your authorization, our secure third-party service will provide us with your bank statements, enabling us to make informed decisions regarding your loan.

- 1. Be at least 18 years old, or 19 years old in BC, NB, and NC.

- 2. Reside in the province of Alberta.

- 3. Demonstrate consistent income from the same source over the past three months.

- 4. Maintain a minimum total net income of $750 per month.

- 5. Possess an active online bank account.

- 6. Provide a valid mobile phone number, email address, and residential address (VOIP numbers are not accepted).

No! Unlike other lenders, ePayLoan does not perform credit checks. We make decisions based on your income and ability to pay the loan

Yes! We accept all income types as long as they meet our requirements. Some examples include child tax, CPP, WICB, Old Age Security, ODSP, and more. Simply fill out the benefit income section in the employment details, and we will handle the rest.