Payday Loan

What do I need to qualify for a payday loan?

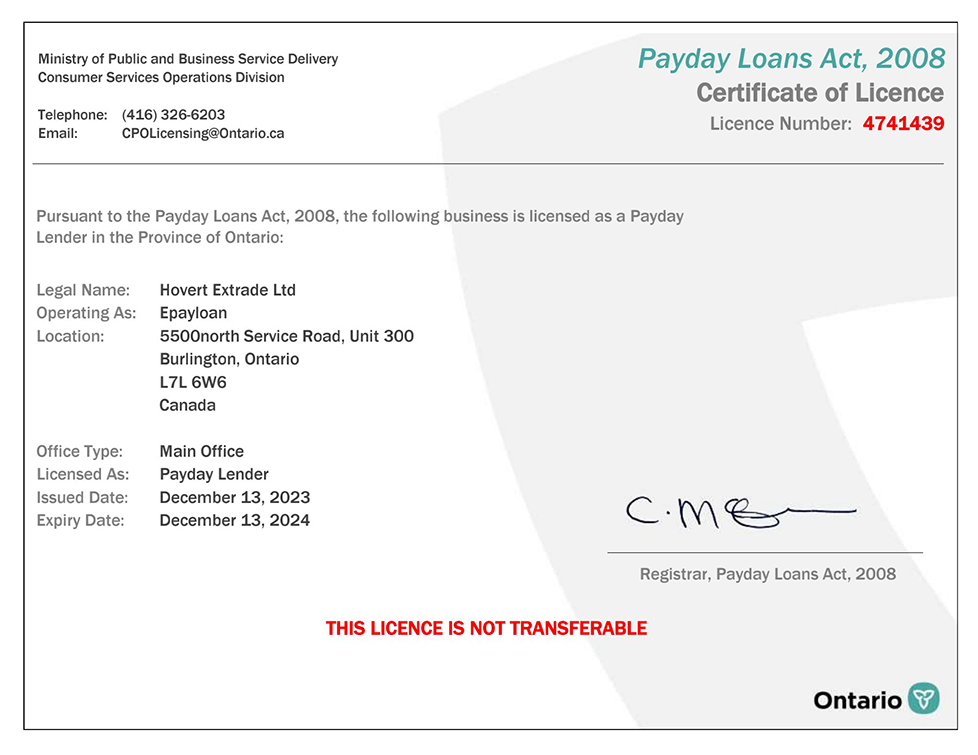

Payday loans are supervised by the government, with each province having its own rules that lenders need to follow. Additionally, lenders may set their own specific requirements. At ePayLoan, the criteria are simplerto qualify for a payday loan compared to other lenders. ePayLoan is known as the Best payday loan lender in Ontario and in Canada. To qualify for a payday loan from ePayLoan, you need to:

- Be at least 18 years old (19 years old in BC, NB, and NC).

- Live in the province where ePayLoan operates.

- Have a consistent source of income for the past three months.

- Earn at least $750 per month in net income.

- Have an active online bank account and can accept the e-transfers.

- Provide a valid phone number, email address, and residential address.

Note: does not do a credit check for a payday loan unlike other lenders. This is the reason we are the best Payday loan lender in Canada.

Are there any payday loans that don't do credit checks??

In Canada, most lenders, whether for auto loans, personal loans, or any other type of loan, will check your credit. This includes most payday loans lenders. However, some lenders, like ePayLoan, offer payday loans and don’t do credit checks. Payday loans have high interest rates and are meant for people who need short-term financial help. ePayLoan don’t do check credit because they decide to approve loans based on your income and ability to repay the loan on time.

So, yes, ePayLoan is a payday loan lender that does not do credit checks and approves loans instantly based on your income and repayment ability.

Do payday loans affect credit?

Payday loans are meant for short-term financial emergencies and have very high interest rates. In Canada, the interest charged can range from $15 to $17 per $100 borrowed, depending on provincial regulations.

Regarding if Payday loan affects your credit score: If you repay the payday loan as agreed, it generally does not affect your credit score. However, if you fail to repay on time and the lender sends your debt to a collection agency, it will negatively affect your credit score. It's important to note that paying off a payday loan on time does not improve your credit score because payday lenders typically do not report to credit bureaus.

Are payday loans bad for credit?

Payday loans are designed to address immediate financial needs and typically carry high interest rates. In Canada, the interest rates can vary from $15 to $17 for every $100 borrowed, depending on provincial laws.

Regarding whether payday loans are bad for your credit: No, they are not inherently bad for your credit if you repay them as agreed. Payday loan lenders typically do not report to credit bureaus. Therefore, payday loans neither negatively impact nor improve your credit score because they are not reported to credit bureaus.

However, if you fail to repay your loan on time, payday loan lenders may send your debt to a collection agency. This action could negatively affect your credit score if you do not resolve the debt promptly. It's crucial to repay your loan on time to avoid any negative impact on your credit score.

As a responsible lender, we only approve loan amounts that we believe you can comfortably repay. This is the also one of the reasons for being the Best Payday loan lender.

Is Payday Loan legal or Illegal?

Yes, payday loans are legal in Canada, but they are regulated to protect people from unfair practices. Both the federal government and the provinces/territories have rules for payday loans. These rules control things like how much you can borrow, how much it costs, and how you have to pay it back.

Federal Rules

The federal government sets a maximum interest rate of 60% per year for most loans. However, payday loans often have special rules because they are short-term loans, and these rules are usually set by the provinces.

Provincial and Territorial Rules

Here is how some provinces regulate payday loans:

- Alberta: The maximum interest rate is $15 for every $100 borrowed.

- British Columbia: The fee is capped at $15 per $100 borrowed, and rollover loans are not allowed.

- Ontario: The cost is capped at $15 per $100 borrowed, with extra protections for borrowers.

- Quebec: Payday loans are almost banned because the maximum interest rate is set at 35% per year.

- Nova Scotia: The fee is capped at $19 per $100 borrowed.

Consumer Protections

Here are some common protections for borrowers:

Clear Information: Lenders must clearly explain the loan terms, costs, and repayment details.

Cooling-Off Period: Borrowers can cancel the loan within a short period (usually two business days) without any penalties.

Repayment Plans: Some provinces require lenders to offer extended repayment plans if borrowers have trouble paying back the loan on time.

No Rollovers: Many provinces do not allow loans to be extended for an extra fee.

Conclusion

Payday loans are legal in Canada, but there are strict rules to protect borrowers from unfair practices. If you are thinking about getting a payday loan, make sure you understand the rules and protections in your province or territory.

Is Payday good or bad?

A payday loan can be beneficial if you need cash quickly for a short-term emergency and are able to repay it on time. While the interest rates are indeed high, payday loans are relatively easy to qualify for and can be obtained quickly. However, failing to repay the loan on time can result in the lender sending the debt to a collection agency, which can negatively impact your credit score.

Which payday loan gives the best money?

Determining the best lender for your needs can be challenging because each lender has its own set of requirements. Some lenders might have stringent approval criteria but offer higher loan amounts if you qualify, while others might provide smaller loans with easier approval processes.

ePayLoan is regarded as one of the leading payday lenders in Canada. Their application process is simple and entirely online, requiring no physical documents. Additionally, they do not perform credit checks, making their decisions based solely on your income and ability to repay the loan. This makes ePayLoan a favorable option for obtaining a payday loan.

Which payday loan is easiest to get?

Determining the best lender for your needs can be challenging because each lender has its own set of requirements. ePayLoan is regarded as one of the easiest payday loan lenders in Canada. Their application process is simple and entirely online, requiring no physical documents. Additionally, they do not perform credit checks, making their decisions based solely on your income and ability to repay the loan. This makes ePayLoan a favorable option for obtaining a payday loan.

Who has the best payday loans?

Payday loans are legal in Canada, but they are regulated to protect people from unfair practices. Both the federal government and the provinces/territories have rules for payday loans. These rules control things like how much you can borrow, how much it costs, and how you have to pay it back.

Determining who provides the best payday loans in Ontario, Canada, can be challenging. Each lender has specific requirements for approval and loan amounts. Some lenders conduct credit checks, which can be problematic for customers with bad credit scores.

ePayLoan is considered one of the easiest payday loan lenders in Canada. Their application process is simple and entirely online, requiring no physical documents. Additionally, they do not perform credit checks, making their decisions based solely on your income and ability to repay the loan. This makes ePayLoan a favorable option for obtaining a payday loan.

Who is the best payday loan online?

Determining who is the best payday loans online can be challenging. Each lender has specific requirements for approval and loan amounts. Some lenders conduct credit checks, which can be problematic for customers with bad credit scores.

ePayLoan is considered one of the best payday loan lenders online in Canada. Their application process is simple and entirely online, requiring no physical documents. Additionally, they do not perform credit checks, making their decisions based solely on your income and ability to repay the loan. This makes ePayLoan a favorable option for obtaining a payday loan.

Payday Loan - Easy Instant Loan Online

ePayLoan is considered one of the easiest payday loan lenders in Canada. Their application process is simple and entirely online, requiring no physical documents. Additionally, they do not perform credit checks, making their decisions based solely on your income and ability to repay the loan. This makes ePayLoan a favorable option for obtaining a payday loan.

Determining who provides the easy payday loans Online can be challenging. Each lender has specific requirements for approval and loan amounts. Some lenders conduct credit checks, which can be problematic for customers with bad credit scores. To qualify for a payday loan from ePayLoan, you need to:

- Be at least 18 years old (19 years old in BC, NB, and NC).

- Live in the province where ePayLoan operates.

- Have a consistent source of income for the past three months.

- Earn at least $750 per month in net income.

- Have an active online bank account and can accept the e-transfers.

- Provide a valid phone number, email address, and residential address.

Easy PayDay Loan Canada

ePayLoan is one of the easiest payday loan lenders in Canada. Their application process is simple and fully online, with no physical documents needed. They do not perform credit checks, basing their decisions on your income and ability to repay the loan. This makes ePayLoan a good option for getting a payday loan.

Finding the easiest payday loans online can be challenging. Each lender has specific requirements for approval and loan amounts. Some lenders check your credit, which can be difficult if you have a bad credit score.

To qualify for a payday loan from ePayLoan, you need to:

- Be at least 18 years old (19 years old in BC, NB, and NC).

- Live in a province where ePayLoan operates.

- Have a steady source of income for the past three months.

- Earn at least $750 per month in net income.

- Have an active online bank account that can accept e-transfers.

- Provide a valid phone number, email address, and residential address.