Emergency Loans in Canada: The Panacea to Unpredictable Circumstances

Life, indeed, is full of surprises; with some very sweet and others not so sweet. You might wake up one morning and find yourself in the midst of some unexpected medical bill, car repair, or an urgent bill that you have to pay. Such are the times when a regular budget goes only so far. That's where emergency loans in Canada come in. They may be used to give you temporary relaxation during trying times, thus putting you back on your feet when you seem to be sinking deeper into financial catastrophe.

What Are Emergency Loans in Canada?

Emergency loans in Canada are short-term and unsecured loans intended to solve people's unexpected financial emergencies. Unlike most other traditional loans, where someone may have to go through lengthy application procedures or even require collateral, emergency loans are normally swift and straightforward. They, therefore, provide immediate access to cash that may prove quite essential when urgent expenses have to be covered.

Generally, in Canada, these emergency loans can have many other names. Some of them can be payday loans, personal loans, or installment loans. To put it simply, the peculiar characteristic of all these emergency loans is that they are fast. That is, approval typically happens within a few hours, while the disbursal of funds will typically be on the same day or the next working day.

Why You May Need Emergency Loans in Canada?

Emergencies are, without a doubt, unpredictable and frequently arrive when least expected. Here are some of the most common situations where emergency loans in Canada can be very helpful:

Medical bills - Whether it's an injury or a medical condition, the medical expense tends to add up pretty fast. Emergency loans can offer quick relief in finance, so you may focus on recovery rather than the cost.

Breakdown of Car- This is one of the biggest inconveniences if that particular car is your only source of transportation. Therefore, you should seek assistance with emergency loans in Ontario to cover the car repair cost.

Unpaid Bills - Sometimes, they just arrive without warning or at their own time. It might be your rent or your credit card bill; it would be very convenient for you to consider an emergency loan when the deadlines come, and you don't want to face those hefty late fees or lose some of your services.

Unexpected Travel - Sometimes, you may need to make an urgent trip because of family emergencies or for business purposes; in this case, access to quick cash may make a huge difference because you must have some cash to book flights and accommodations.

Advantage Of Emergency Loans in Ontario, Canada

Across the large and diverse territorial space of Ontario, both the city and country populations have a pressing demand for emergency loans. In the city of Ontario, among others, such a fast pace of life comes with a price tag in the form of living costs or an unplanned event. Emergency loans in Ontario are also very easily obtained from online lending companies as well as individual, brick-and-mortar local ones.

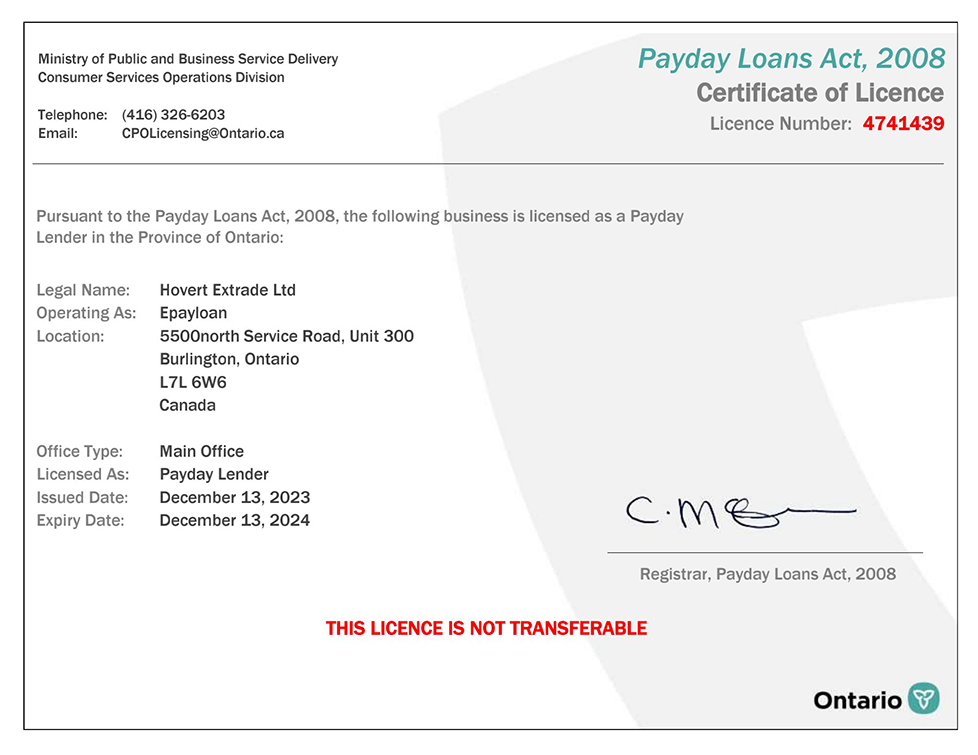

Ontario really boasts a well-crafted regulatory regime for personal lending, meaning that getting an emergency loan in Ontario, in fact, is transparent and places consumer protections. Ontario residents can take advantage of various online lenders that offer flexible loan options with relatively easy terms for defining and accelerated processing through ePayLoan. And with this simplicity of applying from the comfort of one's home, Ontarians are now in a better position than ever before to receive the funds to survive a trying moment.

Emergency Loans Applications in Canada

Applications for emergency loans in Canada are pretty straightforward. The procedures tend to be simple and, therefore, encompass the following:

• Proof of income, which could be represented by recent pay stubs and/or bank statements.

• Government-issued ID (driver’s license or passport).

• Address verification, which can be through a utility bill of recent receipt or a lease agreement.

Once an application is approved, the funds usually get transferred directly into your checking account within a few hours of applying, but this could depend on your situation and lender.

Why Should You Consider Using ePayLoan?

ePayLoan is one of the leading online lenders offering emergency loans in Canada, with a particular focus on residents in Ontario. It offers easy application procedures with very flexible repayment terms. With urgent and adaptable terms, it is the ultimate solution in the event of unexpected cash inflow.

Benefits associated with using the ePayLoan

• Quick cash loan approvals with rapid access to funds.

• Express loan terms that aren't inclined to include hidden fee charges.

• Access the service of loan from your homes.

• Safety and security service.

Emergencies strike, and they are impossible to avoid. Still, something like emergency loans in Canada can prove to be of immense help in taking care of the unexpected cost without slipping into a vicious debt cycle. From Ontario to any other province of Canada, you will find a swift, reliable, and secure lending solution for hurriedly covering the costs at once and resuming peaceful living.

f you have a need for a loan within Ontario or any other region in the country of Canada, then ePayLoan is available to help. Visit the website at www.epayloan.ca today to apply for the loan that will assist you in making your way through unexpected things that come your way.