How Online Payday Loans in Canada Can Aid You out in Emergencies?

We all know that emergencies don't always announce themselves and can arise when we least expect them. At the most terrible moments, you may want quick cash, and this is when online payday loans in Canada come in.

Online financial services are an option for Canadians to access speedy and reliable loans from their homes as the future has arrived. If you are looking for the ultimate relief from all your cash flow predicaments, instant online payday loans in Canada could be just the remedy you are searching for.

What Really Are Online Payday Loans in Canada?

Online payday loans in Canada are sort of short-term loans which provide cash quickly to needy individuals who then intend to repay on their next pay day. It is very simple; most of the time taking not more than a few minutes to apply. Rather than the traditional bank loan, which requires hours of paperwork, this loan allows Canadians to apply online and gives them quick solutions to their financial needs. The amount generally varies from $100 to $1,500 based on the lender and the type of regulations for the province where you might be.

Why Choose Instant Online Payday Loans in Canada?

The most attractive feature of instant online payday loans in Canada is speed. Sometimes, life requires funds immediately and does not always give you time to wait weeks for loans to get secured; payday loans are expected for this type of inconvenience. Just a few clicks later, and if you qualify, before you know it, the funds may be available in your account within hours. This instant access to cash is most suitable in cases where timing is vital, such as emergencies that won't wait for your next paycheck.

How to Apply for Online Loans in Canada?

Applying for an online loan in Canada is easy and hassle free. To apply with most lenders, all you need is basic personal and financial information like your name, address, employment status, and banking details. Usually, only a few minutes are involved in the approval process after submitting the online application, and the funds are deposited in a bank account after approval, often within one business day. It's pretty easy and less complicated, especially for those who do not require a credit check to apply for online payday loans.

Are Online Payday Loans Safe?

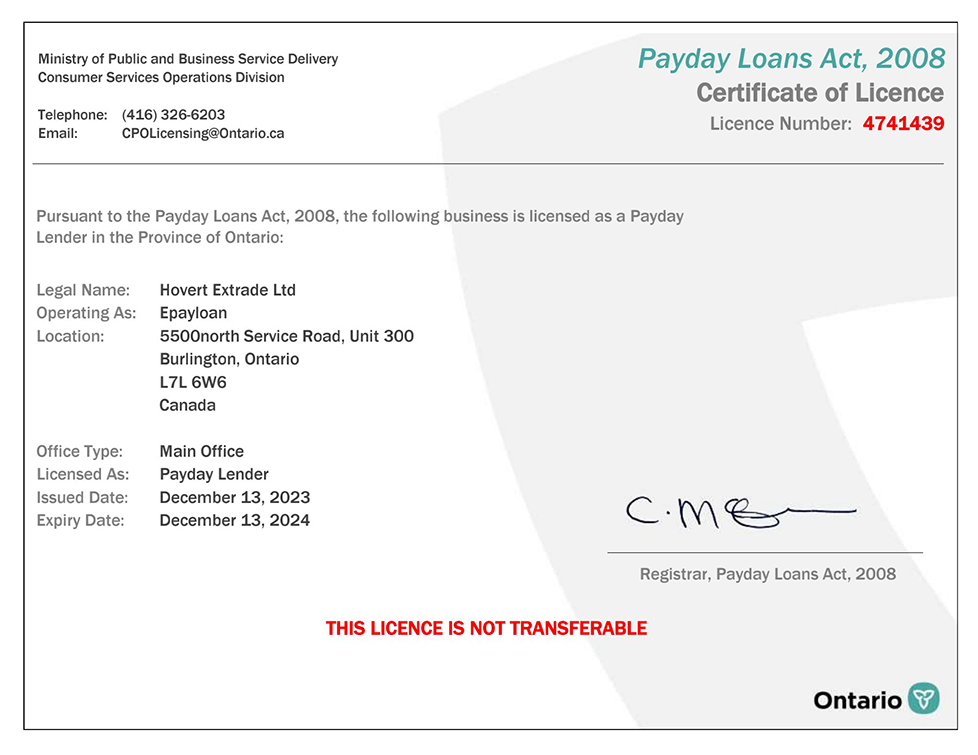

Yes, online payday loans in Canada are completely safe, provided a borrower deals with the most reputable lender. You should select a licensed and regulated lender, as that normally comes with a guarantee in terms of transparency of the terms of the loan and fairness of the interest charges. Choose lenders who comply with provincial standards because they avoid high fees and hidden costs.

Conclusion

For those occasional times that seem to drive Canadians into financial difficulty, instant online payday loans in Canada come in as a savior for easy, instant access. It can really be as easy as it can get for an emergency expense that could not have been anticipated, or for perhaps that dash-in-it this month just short of cash for bills.

However, it is also what really matters; making sure the ability to repay on time to avoid unnecessary debt burdens. The name of the most productive ePay Loan easy application process security online payday loans in Canada enables you to apply for a loan and not make an effort to miss a time for getting funds for when you must use them most. Visit https://epayloan.ca/ to apply today!